Goods must always be shipped through customs before they can be imported into or exported from a non-EU country. Certain formalities, guidelines, and restrictions must be observed. We at TBN are always here for you to ensure you don’t make a mistake or forget anything during the process, so you can concentrate solely on your main business. This helps you avoid lost time and money while managing your resources well.

Customs Export Regulations

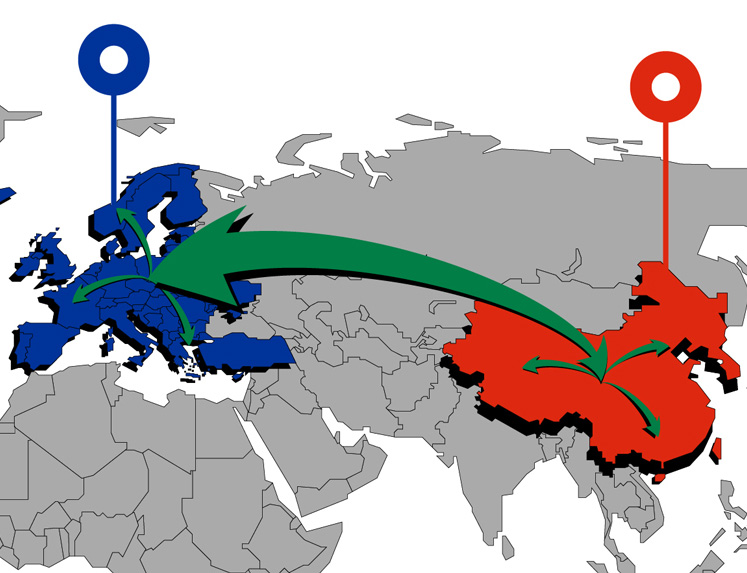

Would you like to export goods to a non-EU country like Japan, Russia, or the USA? Then there are some regulations and formalities you’ll need to take into consideration; these may lead to restrictions or taxes. In general, due to economic provisions or environmental and health regulations it is not possible to export all goods from Germany.

There are certain prohibitions that need to be taken into account. If you don’t face any restrictions, you will still need to process your exported goods through a specific customs process.

Requirements for exports to non-EU countries

To be noted for exports

- There are certain restrictions and prohibitions that apply some groups of goods and countries. These must be taken into consideration in advance.

- Goods are delivered to an export process before customs export to a non-EU country. In some cases, export duties, VAT, and/or consumption tax may be charged.

- You will need an EORI number (number for registering and identifying economic agents) for your customs process.

- Learn about the different export procedures from a customs agency or the responsible customs office.